Published: Wednesday, December 6th, 2023

National Pawnbrokers Day is recognized annually in the U.S. on December 6th and EZCORP is excited to celebrate all Team Members, worldwide, who partake in one of the oldest professions in the world, pawnbroking!

On National Pawnbrokers Day, we honor the rich history of pawnbroking and its enduring significance in modern society. As a cornerstone of financial assistance, pawnshops like EZPAWN have consistently provided a reliable and accessible way for individuals to access funds, regardless of their economic background. This day isn't just about the services we offer; it's about the trust we've earned, the relationships we've built, and the impact we've had on countless lives.

Join us as we delve into the heart of National Pawnbrokers Day, exploring the history of this cherished profession, the vital role pawn shops play in our communities, and the values that drive us at EZPAWN. From humble beginnings to a nationwide network of support, our story is intertwined with the stories of those we've had the privilege to serve. So, let's take a journey together, celebrating the legacy of trust and community that defines both National Pawnbrokers Day and EZPAWN.

Benefits of Pawnbrokers

Pawnbrokers fulfill customers' short-term cash needs and build relationships that last. Pawnbroking services often contribute to the following three benefits:

1. Minimizing carbon footprint: When used items are purchased and sold, there are no additional resources expended to make additional products or packaging. This re-commerce system helps minimize our carbon footprint and directly benefits the environment.

2. Providing better prices: and more access—to merchandise: Purchasing pre-owned items at a pawnshop allows customers to pay less than purchasing the item brand new. Should supply-chain issues occur, pawnshops help make a variety of merchandise more accessible to customers at a wide range of budgets.

3. Helping the community: Pawnshops provide a way to meet customers' short-term cash needs through collateralized pawn transactions1. For many people, banks and other financial services are simply not available.

Fun Fact - The word pawn comes from the Latin word pignus, meaning pledge.

Why We Love National Pawnbrokers Day

1. Here to Stay

Pawn shops have been around for a very long time. That tells us they will exist well into the future. Pawn shops, such as EZPAWN, provide an essential and valuable service to the local communities they operate within.

According to Barchart, “The global Pawn Shop market size was valued at USD $37,773.6 million in 2021 and is expected to expand ..., reaching USD $45,128.42 million by 2027”. Hence, pawn shops are an integral part of the economy!

2. Day To Appreciate Pawn Services

It's likely a good portion of the world could not function without the crucial service that pawnbrokers offer. Honoring the contributions pawnbrokers make to their local economies is what this observance is all about!

3. We Give Back

EZPAWN gives back by providing affordable products & services to the communities it serves. This special day reminds us how important the pawn industry is for underprivileged communities. This can range from better offers to exclusive deals to earning rewards!

Next up, we'll embark on a journey through time, tracing the evolution of the National Pawnbrokers Association, the shops of ancient civilizations to the digitized platforms of today. Let's delve into the history of the industry, uncovering how modern pawnbroking came to be.

The History of Pawn Shops: From Ancient Origins to Modern Markets

The history of pawnbroking is a fascinating journey that stretches back thousands of years, crossing countless cultures and societies. The pawn shop, a staple in modern cities worldwide, traces its roots to the farthest reaches of human civilization. We’ll trace that journey from the ancient world to the present day, showing how the history of pawn shops and National Pawnbrokers Day has evolved and remained relevant across time.

Ancient Beginnings

The earliest roots of pawnbroking can be traced back to the mighty civilizations of ancient China, around 3000 B.C. During this period, pawnbrokers provided peasants with necessary credit that helped them through harsh periods of economic difficulty. Unlike the modern idea of a pawn shop, these early pawnbrokers were often wealthy individuals or families who lent their personal property and wealth to those in need.

Pawnbroking was regulated by the government even then, a testament to its importance to society. However, the interest rates that pawnbrokers could charge pawn customers were often high, reflecting the risk involved in this form of lending.

Expansion and Regulation in Europe

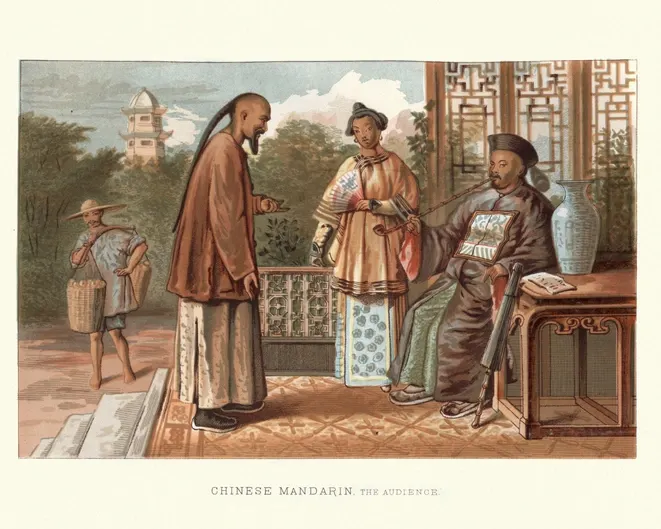

The concept of pawnbroking was not limited to China. As global trade routes opened, the concept of it spread and was adapted to new cultures and economic systems. Around the 5th century, the practice emerged in the Roman Empire. However, it wasn't until medieval times (from ~500 A.D. to 1500 A.D.) that pawnbroking began to resemble what we recognize today.

The Catholic Church played a significant role in this evolution, especially in the regulation of interest rates. In the 14th and 15th centuries, the Church relaxed its rules against usury - the illegal action or practice of lending money at unreasonably high rates of interest - allowing monks to offer secured loans to individuals. Notably, Franciscan Friar Barnabas of Terni founded the “Mount of Piety” in Perugia, Italy, in 1462. This was a charitable institution providing low-interest loans and free loans to the poor, funded by charitable donations, and it marked a significant step towards the modern pawnbroking model.

The Pawnbrokers Act and Modern Pawnbroking

The pawnbroking trade continued to evolve into the 18th and 19th centuries, especially in England. By this time, pawnbrokers were established members of society, and their services were widely used. In fact, it's estimated that by the 18th century, more people in England had dealings with pawnbrokers than with any other type of lending institution.

Regulation came with the Pawnbrokers Act of 1785, which set maximum interest rates and regulated the industry to protect both the lender and borrower. It also introduced the pawnbroker symbol of three golden spheres hanging from a bar, derived from the Medici family's (powerful bankers and pawnbrokers during the Renaissance) coat of arms.

Pawn Shops in the New World

As Europeans crossed the Atlantic, they brought pawnbroking with them to the New World. During the Great Depression in the United States, pawn shops were one of the only institutions offering credit. They provided a lifeline for many struggling families who had no other way to obtain cash.

Pawnbroking in the 21st Century

In the 21st century, pawnbroking has continued to adapt to the times. With the advent of reality television, some shows have brought aspects of the pawnbroking business into the mainstream, showcasing the unique and valuable items that can come through a pawn shop's doors. Online pawn shops have also appeared, offering loans against goods and pawned items without requiring customers to leave their homes.

Despite changes in the economic landscape and societal attitudes towards lending, the core function of pawn shops remains the same as it was in ancient China - providing quick, collateral-based loans to those in need. While they may no longer be the first choice in banking, their services are just as essential today as they were thousands of years ago.

Reflecting On National Pawnbrokers Day And The History Of The Pawn Industry

National Pawnbrokers Day is all about recognizing the importance of pawnbrokers and the business at large. At times, pawn shops don't get the recognition they deserve; notoriously being portrayed as the bad guys. However, we encourage you to visit an EZPAWN today to see that this isn't true! We are an essential service providing quick cash loans for a large number of people and we reduce countless amounts of waste through the retail side of our business! We are one of the first recyclers! Many people are beginning to recognize the importance of pawn shops.

The next time you walk past a pawn shop, take a moment to consider the rich history behind it. From ancient China to modern city streets, pawn shops have always been and continue to be a vital part of our global economic fabric. Visit a location near you today and find out for yourself!

1 Pawn transactions are based on the appraised value of the item presented. Item appraisal and the amount offered are determined at the sole discretion of the pawnbroker. For example, a pawn transaction of an item appraised at $120.00 has a maturity date of one month from the transaction date and requires the repayment of the loan amount plus 20% or $24.00 in fees for a total repayment of $144.00, APR varies by state, if the customer wishes to redeem their item.

2 Barchart | Pawn Shop Market Size and Forecast to 2030 | Aug 30th, 2023